Running rings around fraudsters: Detecting and preventing transaction fraud

Merchants are facing rising fraud attacks, and the methods fraudsters are deploying are becoming increasingly harder to detect and prevent using traditional anti-fraud management solutions. Marija Solovjova, Head of Fraud AML Transactions Disputes Oversight Department, Ecommpay, explains how graph analysis is uncovering complex fraud rings to help combat online fraud.

In the past few years, fraud has been on the rise for consumers and merchants alike. Our recent research revealed that 58% of UK businesses have reported an increase in online fraud or attempted fraud, which has worsened since inflation began to rise in 2021.

For the first half of 2023 alone, UK Finance reported that £580 million was stolen by criminals, with more than 1.2 million instances of payment card fraud. Globally, data from Statista showed the value of e-commerce losses to online payment fraud in 2023 reached $48 billion USD.

Criminal gangs are targeting e-commerce merchants armed with an in-depth knowledge of how to exploit their business processes for chargebacks and refunds, while stealing the card and payment data of consumers through increasingly elaborate phishing and social engineering scams.

The challenges facing merchants

Merchants face many challenges in detecting fraud, ranging from the sophistication of fraudsters to the evolving nature of fraudulent techniques. Fraudsters continually refine their methods, making them harder to detect as they employ advanced technologies and tactics. Without a robust anti-fraud strategy in place, merchants are sitting ducks.

The MRC 2024 Global e-commerce Payments & Fraud Report revealed that 30-40% of merchants identified gaps in fraud tool capabilities, a lack of internal fraud management resources, and limited data access/availability. These combined factors are significantly impacting their abilities to manage fraud effectively.

Additionally, the report highlighted that merchants struggle to keep up to date on new attacks, risk models, and rule changes, manage fraud across different sales channels and geographic markets, and leverage data and tools to effectively prevent and mitigate fraud.

Criminals collaborate well. So well, in fact, that single fraud campaigns are increasingly dependent on a long chain of bad actors supporting and monetising them, and a shared criminal infrastructure.

With all this in mind, it may feel like merchants are fighting a losing battle. However, new anti-fraud solutions are helping them to fight back, providing them with more efficient ways of detecting and preventing fraud.

Running rings around fraudsters

Merchants simply cannot hope to fight modern-day fraud with old methods and mindsets. It’s time for a new approach. Ecommpay uses a multi-layered approach to fraud detection, leveraging advanced technologies such as machine learning and behavioural analytics, coupled with manual fraud detection. And recently, a new feature was introduced to our arsenal - an advanced graph analysis tool that allows us to detect ‘fraud rings’ which uncover a complex ecosystem of bad actors who are interconnected.

The graph analysis provides the opportunity to visualise the connected payment credentials. This helps to map the relationships between linked entities in a network and identify and stop multiple instances of fraudulent behaviour by spotting suspicious patterns before criminals can take action.

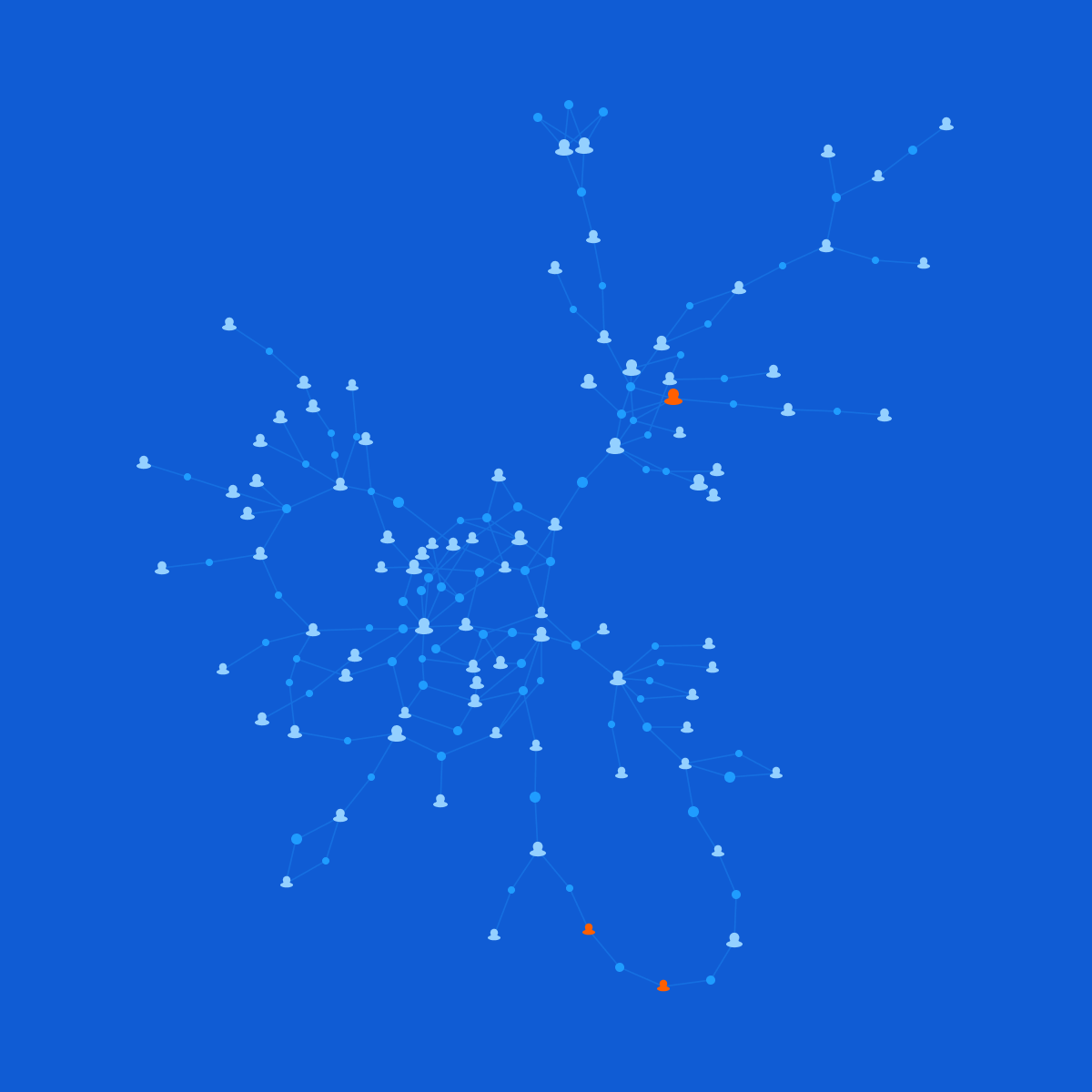

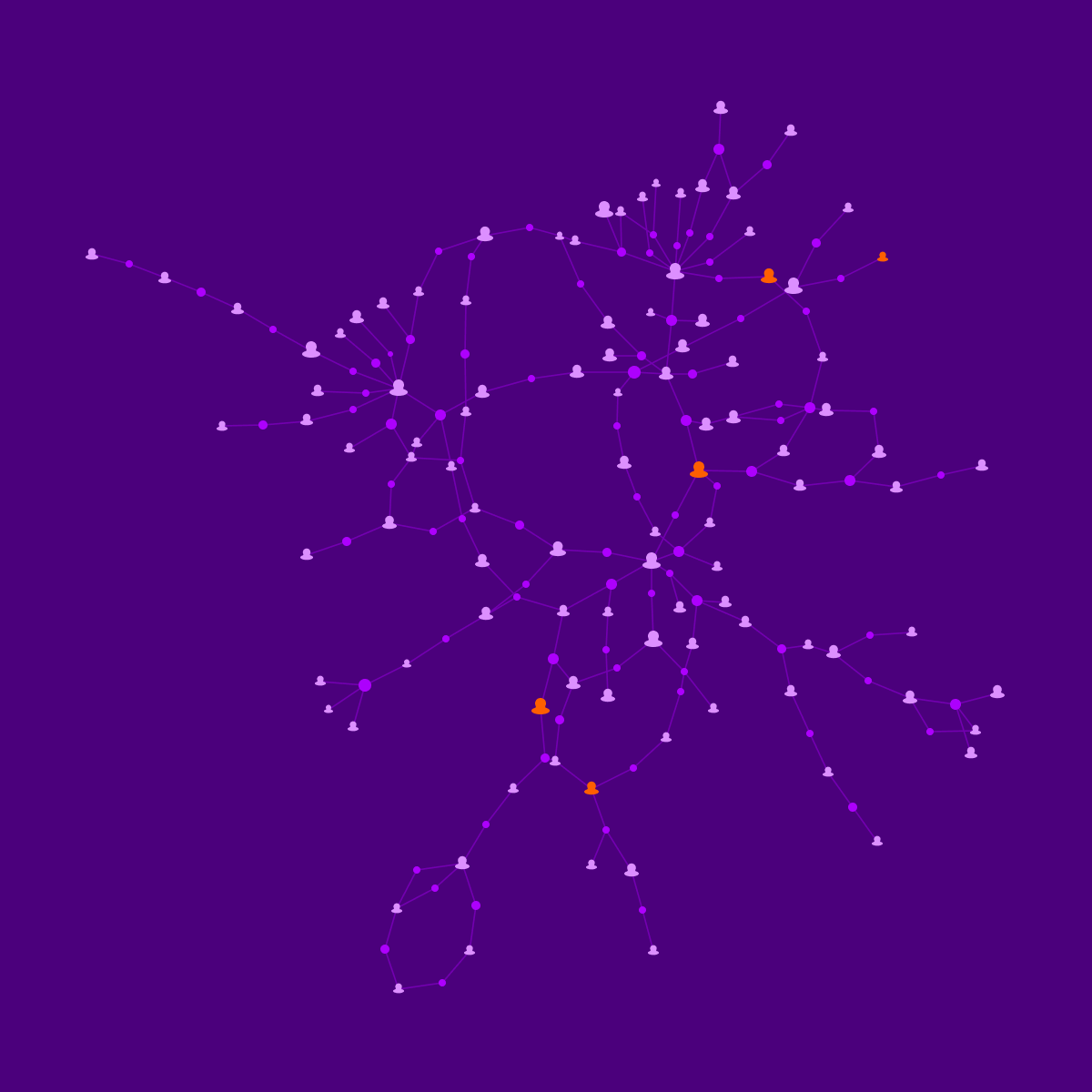

Figures 1 & 2 visualise various fraud rings. In these examples, the red nodes are confirmed fraudsters. The system blocks the red nodes and other connections in the chain. It neutralises the threats, until the criminals stop. If new connections join the chain, or criminals try to start a new chain elsewhere, graph analysis can spot this, flag it for investigation or shut it down.

This technology has already been recommended as a useful tool for detecting fraudulent patterns, even if separate parts of them look genuine. Overall, the graph analysis provides a robust framework for detecting and monitoring fraud by leveraging the complex network of customer interactions in our merchant's traffic. Furthermore, it allows analysts to uncover hidden patterns and connections that traditional methods may overlook.

Another key element of fraud-fighting is self-learning. Graph analysis relies on Machine Learning to anticipate new fraud attacks and improves over time and data. Models and analysis also improve over time and data, allowing businesses to add historical data to enhance future fraud detection and stop dormant fraudsters in their tracks by preempting potential fraud attacks.

During 2023, Ecommpay's graph analysis has revealed more than 12,000 fraud rings, across over 130 merchants. In total there were more than 25,000 unique customers involved, about 14,000 of them have been reported as fraudsters, while others were part of unreported or unsuccessful fraud attacks.

Graph analysis is just an additional (yet very powerful) tool for fraud detection. However, this forms part of a much wider, holistic approach to tackling fraud.

The never-ending battle

Fraudsters pose a multifaceted and ever-changing threat to e-commerce merchants.

Fortunately, advanced machine-learning tools such as our award-winning graph analysis can detect these threats. Implementing intelligent, adaptive, holistic, and people-centric anti-fraud strategies gives businesses an advantage in the battle against online fraud.

While the graph analysis tool has proven to be an effective and powerful addition to our existing anti-fraud solution, it is important to note that graph analysis was never designed to function as a standalone solution. A multi-layered approach to fraud prevention requires multiple systems working together to provide valuable information and insights. All of our tools for fighting fraud are constantly being refined to maximise the collective impact when fighting evolving fraud patterns.

The application of AI to combat fraud has been widely hyped as a game changer, too. But you can only build a good Machine Learning model with a good understanding of what and how happens in traffic.

For this reason, one of our core domains is still the work of our fraud analysts, who possess a great amount of knowledge about how fraudsters work and how fraud looks in traffic. Ecommpay’s dedicated team of anti-fraud experts add human insight and 24/7 support to the machine’s existing capabilities without impacting customer journeys or real customers.

Flexibility and customisation are incredibly important. Every merchant is different, and so a fraud solution must be tailored to their specific needs.

Ecommpay has built its own proprietary Risk Control Management System in-house. This gives us full control over the customisation of anti-fraud filters depending on individual customer needs, which in turn helps deliver high conversion rates and maximises revenues.

Different e-commerce merchants experience different types of fraud depending on what goods they are selling, where they are based, and what sales channels they utilise, which is why a tailored approach is so crucial. For this reason, Ecommpay has 60+ anti-fraud filters which businesses can customise, according to limits, restrictions and scenarios.

A comprehensive approach with a combination of technologies, including AI-powered automated monitoring, traditional rules-based techniques, and hand-on-the-door interventions, is the key to effective fraud prevention, both now, and in the future.